Are you considering how to pass your home to your family without a significant tax hit? A qualified personal residence trust (QPRT) might be the answer. This tool can lower the value of your taxable estate and reduce taxes for your loved ones, but it only works if you follow the rules and plan ahead.

An estate planning lawyer from Pennington Law, PLLC can explain how QPRTs work and help you determine whether this kind of trust fits your goals. Contact our firm today to arrange your free initial consultation and start building your estate plan with confidence.

What Is a Qualified Personal Residence Trust (QPRT)?

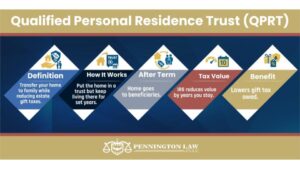

A qualified personal residence trust allows you to transfer your home to family while reducing estate and gift taxes. With this kind of qualified trust, you transfer the home into a trust but keep a retained interest to live there for a specified term – a set number of years. After the term ends, the home goes to your chosen beneficiaries. You no longer own it, but you can still live there.

The Internal Revenue Service (IRS) uses your home’s current value, minus the time you plan to keep living there, to determine its value as a gift to your beneficiaries. Because the taxable value of the gifted home decreases based on the amount of time you continue to live in it, your beneficiaries don’t owe as much in gift tax.

Benefits of Establishing a QPRT in Arizona

With an effective QPR trust, you can transfer a home to your loved ones in a way that reduces the tax burden associated with the gift. If you expect your home to grow in value or simply want to make the most of current estate tax laws, a QPRT might be worth considering. Here are several possible benefits of establishing this type of trust:

- Lowers Gift Tax Value: When you set up a QPRT, the IRS doesn’t use the home’s full value to calculate gift tax once it’s transferred to your beneficiaries. This reduced gift tax cost can help your loved ones receive a valuable asset with less of a financial burden associated with it.

- Freezes Your Home’s Value: A QPRT locks in the value of your home at the time of the transfer. Future appreciation in the home’s value happens outside the estate and isn’t subject to gift tax.

- Allows You to Live in the Home Without Paying Rent: As the owner, the grantor retains the right to keep living in the home for the full QPRT term without paying rent.

- Continues Giving After the Term: If you still want to live in your home after the trust term ends, you can rent it at market value. That rent payment reduces the size of your estate even more for estate tax purposes.

- Protects Assets from Creditors: Once you move your home into a QPRT, it’s no longer yours under the law. That can make it more difficult for creditors to claim the property.

- Takes Advantage of Today’s Tax Laws: QPRTs let families take advantage of current gift and estate tax limits, which are subject to change in the future.

- Keeps Property in the Family: Depending on how it’s written, a QPRT’s trust structure can keep your home under family control for generations. This can be particularly beneficial in a high-interest rate environment where home ownership may not otherwise be possible for loved ones.

To avoid IRS scrutiny and ensure that the transfer ownership accomplishes your desired estate tax savings, you should seek professional guidance from an experienced estate planning attorney.

How Does a QPRT Work?

You set up a QPRT by transferring your personal residence into it and choosing your term, which is the amount of time you want to keep living in the home. The term can be based on your personal preference and objectives, such as for your life expectancy or a ten-year period, for example. During the term, you live in the home rent-free. After the term ends, the home belongs to your beneficiaries. If you still want to stay in the home, you’ll need to pay fair market rent.

The longer the term, the lower the gift value the IRS counts against you. However, there is a key trade-off. If you die before the term ends, the home goes back into your estate at full value, which would negate the tax benefits.

Qualified personal residence trusts can apply to a primary or secondary residence, such as a vacation home. The property transferred into a QPRT must be the grantor’s principal residence or a residence used for personal purposes for at least fourteen days of the year or, if more than fourteen days, for ten percent of the number of days per year that it is rented. You can only have term interests in up to two QPRTs at one time.

Risks and Benefits of a QPRT

Like any estate planning tool, a QPRT comes with certain risks. This type of trust works best when the person setting it up outlives the trust term. If something changes, like a sudden move or a death during the term, it could cause problems. Before you decide to move forward with a qualified personal resident trust, you should think about the following potential drawbacks:

- If you die before the term ends, the home goes back into your estate. That means the grantor’s estate could owe more in taxes than the grantor originally anticipated or planned for, which would undo the QPRT’s main benefit.

- You won’t get a step-up in basis. If your beneficiaries sell the home later, they could owe capital gains tax on the full increase in value since you bought it.

- You can’t modify the trust after it’s set up. A QPRT is a type of irrevocable trust. Once you sign and fund it, the terms are locked in, even if your plans or needs change later.

- You’ll have to pay rent if you stay after the term. Once the QPRT ends, you must start paying your beneficiaries the fair market value of the rent to maintain the tax benefits.

- You must follow strict QPRT rules if you want to sell the home. If you sell your home while it’s in the trust and don’t buy a replacement soon, you could lose the tax advantages.

- You’ll need to budget for legal and tax costs. You will need to cover legal fees, appraisals, and filing costs up front to set up a QPRT, which might not be worth it if you have a smaller estate. Any payment toward the home that the trust’s beneficiaries should rightfully pay could be considered a taxable gift to them.

To ensure you understand the tax implications and potential drawbacks of a QPRT, you should work with a qualified trust lawyer if you are considering making a QPRT as part of your estate plan.

Is a QPRT Right for You?

A QPRT works best for people who expect to live for many more years and want to reduce their future estate taxes. It can also be useful if the property appreciates and you want to lock in its present value. Still, QPRTs come with strict rules, some risks, and additional costs. You must forfeit full ownership of your home and follow specific rules about what happens during and after the term. An estate planning attorney can help you review your broader financial and estate planning goals to determine whether this powerful estate planning tool is right for you.

Consult an Arizona Estate Planning Attorney

Clients trust Pennington Law, PLLC to guide them through important estate planning decisions with clear advice and steady support. Here’s what one recent client had to say:

“They made a complex process smooth and easy!”

—Ron Jett

If you’re ready to make a plan for your home and want to maximize estate tax benefits, contact Pennington Law, PLLC today. We offer free initial consultations and can help you explore all of your options.